sacramento county tax rate

The current total local sales tax rate in Sacramento CA is 8750. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700.

Sacramento County Transfer Tax Who Pays What

The median property tax on a 32420000 house is 220456 in Sacramento County.

. This is mostly due to the general tax levy of 1. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The California state sales tax rate is currently.

How much is the documentary transfer tax. Some property owners in San Diego City have a 117461 tax rate while some in Chula Vista have a rate of 114221. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls.

Total Statewide Base Sales and. 6 rows The Sacramento County California sales tax is 775 consisting of 600 California state. You can find more tax rates and allowances for Sacramento.

Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025. The most recent secured annual property tax bill and direct levy information is available online along with any bill s issued andor due in the most recent fiscal tax year through e-Prop-Tax Sacramento Countys Online Property Tax Information system. The sacramento county california sales tax is 775 consisting of 600 california state sales tax and 175 sacramento county local sales taxesthe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. Our Mission - We provide equitable timely and accurate property tax assessments and information. Property information and maps are available for review using the Parcel Viewer Application.

A county-wide sales tax rate of 025 is. 2021-2022 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918. 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer.

T he tax rate is. 025 to county transportation funds. Sacramento Countys average tax rate is 68 of assessed home values slightly less than the state average of 74.

Thats up from 56 of counties in the third quarter of 2020 and marks the worst rate since 2008. 075 to city or county operations. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value.

This includes Secured and Unsecured supplemental escaped additional and. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The median property tax on a 32420000 house is 340410 in the United States.

How much is county transfer tax in Sacramento County. This is the total of state and county sales tax rates. Sacramento-county Property Tax Records Sacramento-county Property Taxes.

The median property tax on a 32420000 house is 239908 in California. Revenue and Taxation Code Section 72031 Operative 7104 Total. Has impacted many state nexus laws and sales tax collection requirements.

Learn more About Us. The December 2020 total local sales tax rate was also 7750. Sacramento county tax rate area reference by primary tax rate area.

The Sacramento County sales tax rate is. Sacramento County has property tax rates that are similar to most counties in California. Citizens pay roughly 291 of their yearly income on property tax in Sacramento County.

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025. Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by. The December 2020 total local sales tax rate was also 8750.

The current total local sales tax rate in Sacramento County CA is 7750. The tax rates are expressed as dollars per 100 of assessed value therefore the tax amount is already divided by 100 in order to obtain the correct value. To review the rules in California visit our state-by-state guide.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. The 2018 United States Supreme Court decision in South Dakota v. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County.

Based on that rate the average Sacramento County tax bill is about 2204 a year. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of 29. 33 rows The Sacramento County Sales Tax is 025.

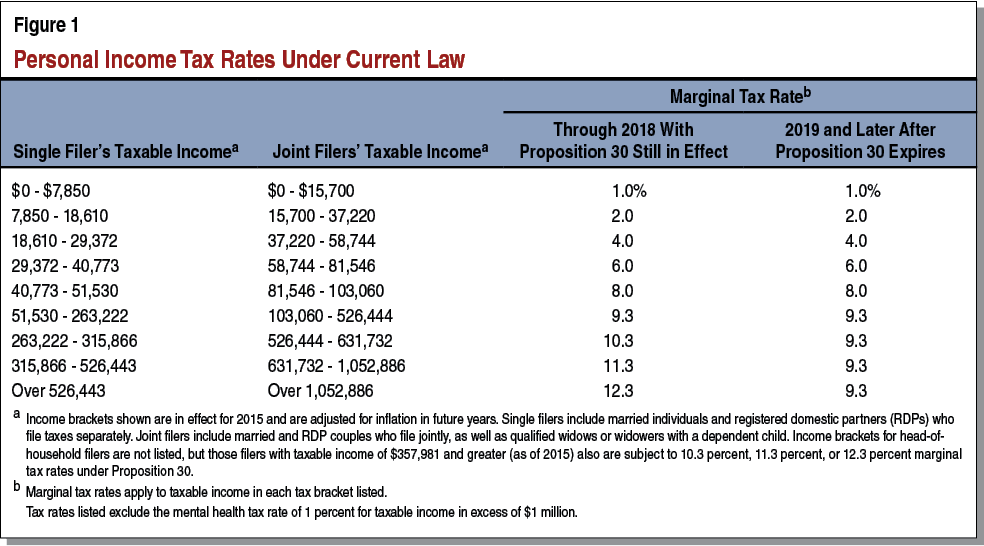

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Secured Property Taxes Treasurer Tax Collector

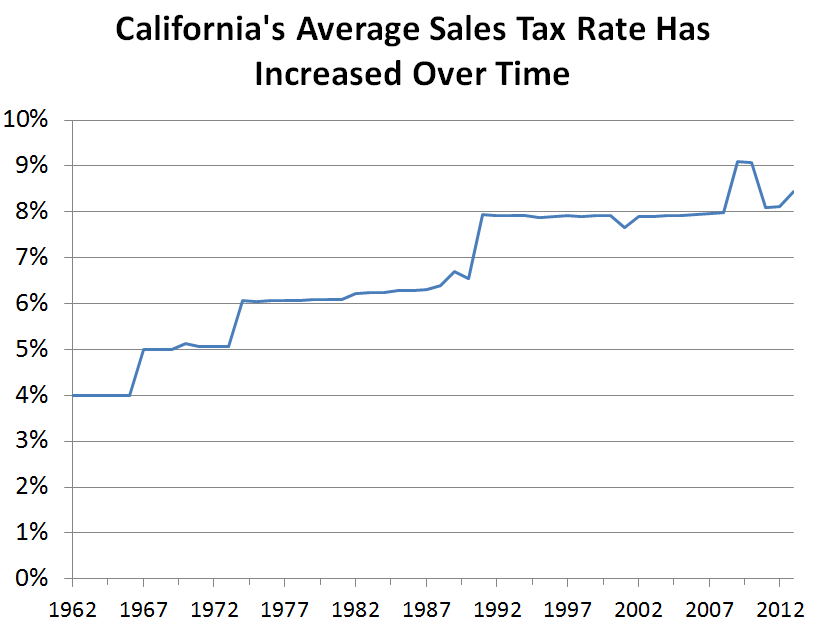

Understanding California S Sales Tax

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Tax Rates H R Block

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Personal Income Taxes And Funding For Education And Health Programs Amendment No 1 Ballot

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

California City County Sales Use Tax Rates

Secured Property Taxes Treasurer Tax Collector

California Sales Tax Rates Vary By City And County Econtax Blog

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Understanding California S Sales Tax

California S Sales Tax Rate Has Grown Over Time Econtax Blog